An exchange-traded fund, or ETF, is a type of investment fund that functions very similarly to stocks in terms of how it is traded. ETFs offer benefits that usually come with index funds, such as tax efficiency and user-friendly diversification, alongside some of the perks of standard stocks such as short selling. People invest their assets in ETFs in hopes of enjoying financial growth with relatively low maintenance.

With so much to offer, how large can ETFs get? Today we’ll be looking at 10 of the largest ETFs in the world and ranking them according to their total assets under management!

-

iShares Core MSCI Emerging Markets ETF

Exchange Symbol: IEMG

Average Volume: 14,569,391

Year Founded: 2006

Source: wikimedia.org

Source: wikimedia.org

The whole family of iShares ETFs is owned and managed by BlackRock, a global investment management corporation with an enormous worldwide presence. These ETFs were previously known as the World Equity Benchmark Shares (WEBS) when they were first launched by Morgan Stanley, but were later rebranded as part of the new iShares project, which was launched by Barclays.

Did You Know?

The iShares Core MSCI Emerging Markets ETF’s holdings include famous names such as the Alibaba Group and Tencent Holdings.

-

Vanguard FTSE Emerging Markets ETF

Exchange Symbol: VWO

Average Volume: 12,846,104

Year Founded: 2015

Source: wikimedia.org

Source: wikimedia.org

The Vanguard FTSE Emerging Markets ETF is ideal for investors who want a good balance of low costs, flexibility, and broad investment diversification. The Vanguard Group seeks to mirror this set of values through most of its different share classes, since the Vanguard firm as a whole maintains the goal of reducing costs for individual investors.

Did You Know?

In addition to ETFs and mutual funds, the Vanguard Group also provides asset management services, financial planning, and educational account services.

-

iShares Core U.S. Aggregate Bond ETF

Exchange Symbol: AGG

Average Volume: 3,709,471

Year Founded: 2003

Source: wikimedia.org

Source: wikimedia.org

The iShares Core U.S. Aggregate Bond ETF is meant to serve as a way for people with fixed incomes to diversify their portfolios and increase their income while still enjoying a good bit of stability. Its accessibility makes it a popular choice for people who are trying to familiarize themselves with ETFs without too much risk.

Did You Know?

BlackRock aims to make investing more transparent and accessible through its iShares solutions so that more people can take advantage of its potential.

-

iShares Core MSCI EAFE ETF

Exchange Symbol: IEFA

Average Volume: 7,631,050

Year Founded: 2006

Source: wikimedia.org

Source: wikimedia.org

The MSCI EAFE stock market index is specifically designed to keep track of equity market performance in other developed countries apart from Canada and the United States. Each of this index’s securities is weighted according to its market capitalization, which means that its value can fluctuate on a daily basis. As such, this type of ETF is best suited for investors with their sights set on long-term growth.

Did You Know?

The acronym EAFE stands for Europe, Australasia and the Far East.

-

Vanguard FTSE Developed Markets ETF

Exchange Symbol: VEA

Average Volume: 9,185,698

Year Founded: 2010

Source: wikimedia.org

Source: wikimedia.org

The Vanguard Group launched its FTSE Developed Markets ETF to provide investors with the ability to match the stock performances of large, mid, and small-cap companies throughout major European and Canadian markets. This ETF is diversified across several different value styles and types of growth potential because of its multinational presence, and it’s conveniently low on expenses as well. for investors with their sights set on long-term growth.

Did You Know?

The Vanguard FTSE Developed Markets ETF’s approach is passively managed.

-

Invesco QQQ

Exchange Symbol: QQQ

Average Volume: 28,741,402

Year Founded: 2002

Source: wikimedia.org

Source: wikimedia.org

QQQ ETFs track the Nasdaq 100 Index, which encompasses approximately 100 of the largest international and domestic companies listed on the Nasdaq stock exchange. In addition to a strong presence on the stock exchange, Invesco QQQ also reliably hosts a professional golf tournament with hefty prizes that can get as high as two million USD! The competition is held at the Sherwood Country Club in California.

Did You Know?

Other tournament sponsors besides Invesco include Dole, Mercedes-Benz, and United Rentals.

-

Vanguard S&P 500 ETF

Exchange Symbol: VOO

Average Volume: 2,607,327

Year Founded: 2010

Source: wikimedia.org

Source: wikimedia.org

The Vanguard S&P 500 ETF primarily focuses on tracking large-cap domestic stocks, and is considered by many to be a key representation of the United States stock market as a whole. Some of this ETF’s topmost holdings are big-name companies such as Amazon, Microsoft, and JPMorgan & Chase. The Vanguard S&P 500’s primary sectors are health care, technology, and financial services.

Did You Know?

The main risk factors of the Vanguard S&P 500 ETF are directly tied to the United States economy and broad market.

-

Vanguard Total Stock Market ETF

Exchange Symbol: VTI

Average Volume: 2,660,835

Year Founded: 1992

Source: wikimedia.org

Source: wikimedia.org

The Vanguard Group experienced a significant period of growth after the start of the bull market in 1982 and responded by launching a series of new funds to provide investors with a more advantageous set of options. New funds included a variety of other stock index funds alongside the Vanguard Total Stock Market ETF. This well-timed expansion allowed the Vanguard Group to grow some of the largest investment funds in the world.

Did You Know?

The Vanguard Total Stock Market ETF utilizes a passively managed index sampling strategy with minimal expenses.

-

iShares Core S&P 500 ETF

Exchange Symbol: IVV

Average Volume: 3,889,691

Year Founded: 2000

Source: flickr.com

Source: flickr.com

This ETF provides investors with a tax-efficient and relatively low-cost way to improve their chances of fund growth over time by connecting with large, reputable American companies. The iShares Core S&P 500 claims to prioritize investment success over the profits that it can gain from fees and expenses in order to make it more investor-friendly.

Did You Know?

The S&P 500 is also known as the “underlying index”, which quantifies the success of the United States equity market’s large-capitalization sector and accounts for approximately 90% of this ETF’s assets.

-

SPDR S&P 500 ETF

Exchange Symbol: SPY

Average Volume: 71,182,352

Year Founded: 1993

Source: wikimedia.org

Source: wikimedia.org

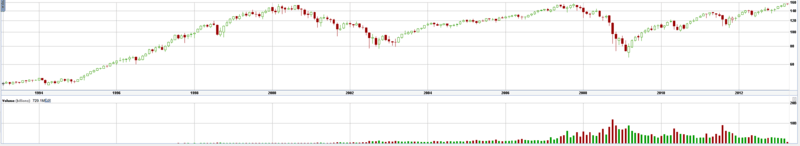

The SPDR S&P 500 ETF is the largest ETF in the world by assets under management. It is similar to the iShares Core ETF in that it also strives to replicate the performance of the S&P 500 index, but sometimes comes with higher costs. The SPDR S&P 500 was also the first US-listed ETF to be launched. This ETF is unique because its holdings are selected by a committee, sometimes resulting in the rejection of stocks that other funds might include.

Did You Know?

The SPDR S&P 500 ETF’s primary holdings include household names such as Apple, Facebook, and Berkshire Hathaway.